That's a quite substantial quantity of money.

Some of these threats involve your driving record. If you have actually entered into previous scrapes or received citations for driving recklessly or under the influence, your rates will nearly definitely be greater than a chauffeur with a squeaky-clean record. Some of the elements have to do with characteristics outside of your control, like your age and gender.

Since of these trends, your car insurance coverage will cost more as a teenager, particularly as a teenage kid. Teenagers entering more accidents than older motorists makes user-friendly sensein basic, they've had much less experience behind the wheel. Insurify analyzed data from hundreds of thousands of vehicle insurance coverage prices quote for teenage motorists to determine their average month-to-month costsand as you might envision, they're quite a bit higher than the typical month-to-month premiums for all U.S.

Another expected trend that the information exposes pertains to age: 19-year olds are the least pricey teenagers to insure, most likely since they have more experience on the roadway and make more fully grown choices while driving. The most pricey category of teen to insure is a male 18-year old.

The Basic Principles Of Average Cost Of Car Insurance (October 2021) - Valuepenguin

Teens trigger the greatest rates of auto mishaps: per mile driven, teenager motorists are nearly three times more likely than chauffeurs aged 20 and older to be in a deadly crash. Average Vehicle Insurance Expense for Young Chauffeurs The early twenties can be an unique time in many people's http://rentalcarinsuranceqezh551.wpsuo.com/the-4-minute-rule-for-am-i-in-over-my-head-spending-3300-on-a-mortgage lives.

Young the adult years also marks a time of modification for vehicle insurance premiums. As chauffeurs get more maturity and experience on the road, their rates reduce on average, though male chauffeurs continue to pay greater premiums than female drivers. There's one interesting aspect you may not expect in guaranteeing young people you might not anticipate: their instructional status.

Insurify's information on cars and truck insurance quotes for young grownups reveals Why does the data recommend that college trainees pay more on typical per month? There are a couple of reasons: trainees tend to be more youthful than non-students, and typically remain on their family insurance coverage policies.

State legislators figure out just how much automobile insurance coverage motorists need to buy, what qualifies as an uninsured chauffeur, what accident-related costs insurance companies are required to cover, and other insurance-related concerns. These policies affect how much automobile insurance coverage costs in each state. Laws aren't the only location-related aspects affecting average automobile insurance coverage expense: Americans drive in a different way in each state and face various difficulties and threats.

Verbal Behavior - Page 124 - Google Books Result for Dummies

Luckily, Insurify has the data to supply you with answers. Read on to learn the typical month-to-month premium for car insurance in all 50 states, in addition to the leading 10 most and least pricey states for automobile insurance coverage. Average Month-to-month Expense of Automobile Insurance Coverage: 50 States and Washington, D.C.

Liability Protection Average Regular Monthly Expense * * All types averaged. Average Auto Insurance Coverage Cost by Insurer Some motorists might be curious about the average monthly vehicle insurance coverage expenses of each insurer. Insurify compared the information from countless automobile insurance prices estimate to identify typical month-to-month vehicle insurance coverage costs by business.

Male $245 Female $236 Average Automobile Insurance Coverage Expense by Marital Status One unexpected element in your month-to-month cars and truck insurance premiums is marital status. If you've been waiting for a factor to pop the question, think about that you may save on your car insurance!

Average Month-to-month Automobile Insurance Cost by Marital Status Married $238 Single $266 Typical Car Insurance Expense: Clean Record vs. A minimum of One Mishap Due to the fact that the main expense for insurer includes spending for medical and property expenses after auto mishaps, a driver with a history of mishaps is generally even more pricey to guarantee, especially if they were discovered to be at fault in one or more of them.

Some Known Incorrect Statements About The Last 2 Child Tax Credit Payments Are Fast Approaching ...

If you spend great deals of time on the roadway, you're statistically more likely to enter into an accident, so your premiums will be higher. Mishaps, moving offenses, and DUI's will all substantially raise your rates. Conclusion: How To Save on Cars And Truck Insurance Coverage Hopefully, this short article assisted you find out more about average vehicle insurance coverage expenses nationwide, in addition to the numerous elements that go into identifying the rate of a driver's automobile insurance coverage premium.

What is the average expense of car insurance monthly? Chauffeurs in the United States deal with a typical monthly premium of around $234 for their car insurance coverage. What is the typical expense of complete coverage automobile insurance? U.S. drivers can expect to pay a month-to-month average of $323 for a full protection automobile insurance coverage package.

If you're in the market for car insurance, you likely have a lot of concerns. Comprehending how insurance coverage suppliers calculate cars and truck insurance rates can assist you not only approximate your spending plan, however also conserve cash by knowing what to avoid in the future.

Keep in mind that points on your license do not stay there forever, but for how long they remain on your driving record varies depending on the state you reside in and the severity of the offense. The price, design and age of your automobile all add to how much cars and truck insurance expenses will be.

Facts About Consumer Price Index Summary - Bureau Of Labor Statistics Uncovered

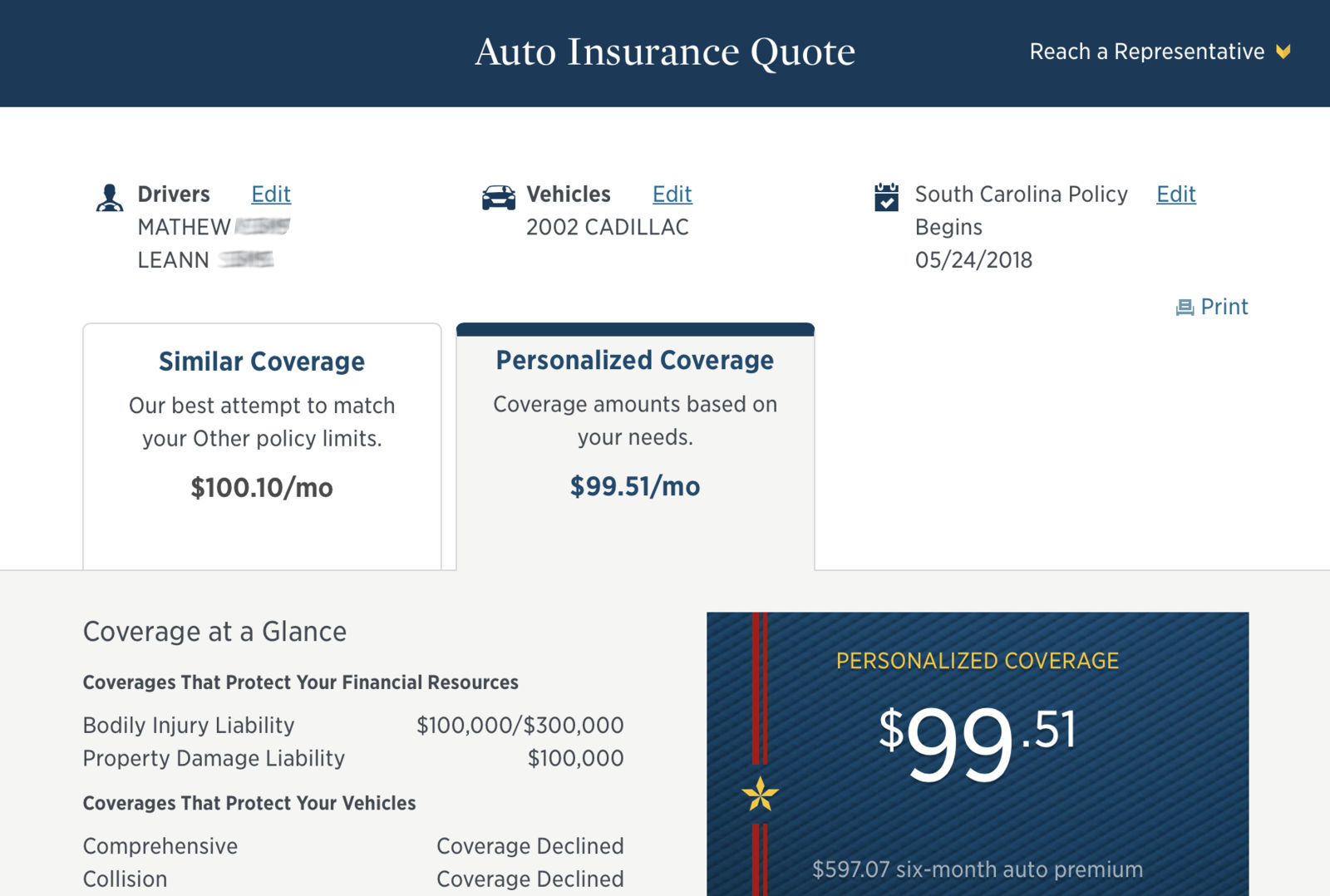

According to the American Auto Association (AAA), the typical cost to guarantee a sedan in 2016 was $1222 a year, or approximately $102 each month. Remember that this is a ballpark figure based on nationally gathered information; depending on your situation, it might be more or less. Nationwide not just provides competitive rates, however also a series of discount rates to help our members conserve even more.

Visit our vehicle insurance coverage quote area and enter your zip code to begin the car insurance coverage quote procedure. Within a few minutes, you'll have an automobile insurance quote based on your particular scenarios. You can likewise talk to a Nationwide agent and get a quote over the phone. .