Ask the representative or producer for something to show that he/she does have full authority, and that the insurer will honor the terms of the binder. The binder needs to be replaced by a complete plan in 90 days or less and the policy have to match (or not problem with) the full plan when the consumer gets it - cheap car.

cheaper auto insurance auto car insurance auto

cheaper auto insurance auto car insurance auto

Yes, as long as the pre paid funeral agreement was participated in by you prior to July of 1995. You need to inform the first funeral home you intend to transfer your pre paid funds over to a replacement funeral provider (the new funeral residence). The regulation calls for the initial funeral house to transfer every one of the proceeds to the brand-new funeral home, what you paid down to money the agreement, minus the accumulated passion - automobile.

Yes. The Department has the ability to provide you some general information, but please keep in mind that the enforcement authority for the Do Not Call legislation (both State and also Federal) lies with the Arkansas Attorney General's Office. Below is the web link to their website for more details; you will need to contact the Customer Security Division of the Public Defense Division: www - perks.

gov Unlike the Federal Profession Payment's Do-Not-Call guideline, the Federal Interaction Compensation's (FCC) Do-Not-Call Guideline applies to the insurance policy market. automobile. Insurance policy agents that utilize the telephone or send out faxes will certainly have to follow the FCC's Rule and also examine the nationwide do-not-call listing even in states that have actually excused insurance coverage agents from their do-not-call policies (like Arkansas!).

A well-known company relationship exists where the customer has actually purchased or participated in another deal within the 18 month period prior to the call or when a query or application has been made within 3 months before the phone call - insurance companies. "cool" calls to numbers on the Do-Not-Call list are prohibited unless reveal composed authorization has actually been provided to call.

It is the Department's understanding that there is existing complication as to the applicability of the previous state-exception for insurance coverage under the brand-new Do Not Call stipulations. A. Yes, life earnings are exempt as stated in Ark. Code Ann.

The Facts About What Is Liability Car Insurance? - Business Insider Revealed

The quantity of protection would be $300,000, or policy limitations, whichever is less - money. The policies not in case status would be marketed to a solvent insurance policy firm. The insurance holder would certainly receive notification of this, a certification from the presuming business and also info as to where to send out premium repayments, make questions, data insurance claims, etc.

In 1990 Union Life Insurance policy Firm was combined into Jefferson National Life Insurance Policy Company. Conseco Variable Insurance Company changed its name to Jefferson National Life Insurance Company and entered right into an agreement with Protective Life Insurance Coverage Firm of Birmingham, Alabama to service the Union Life business.

business insurance cheap car insurance vehicle dui

business insurance cheap car insurance vehicle dui

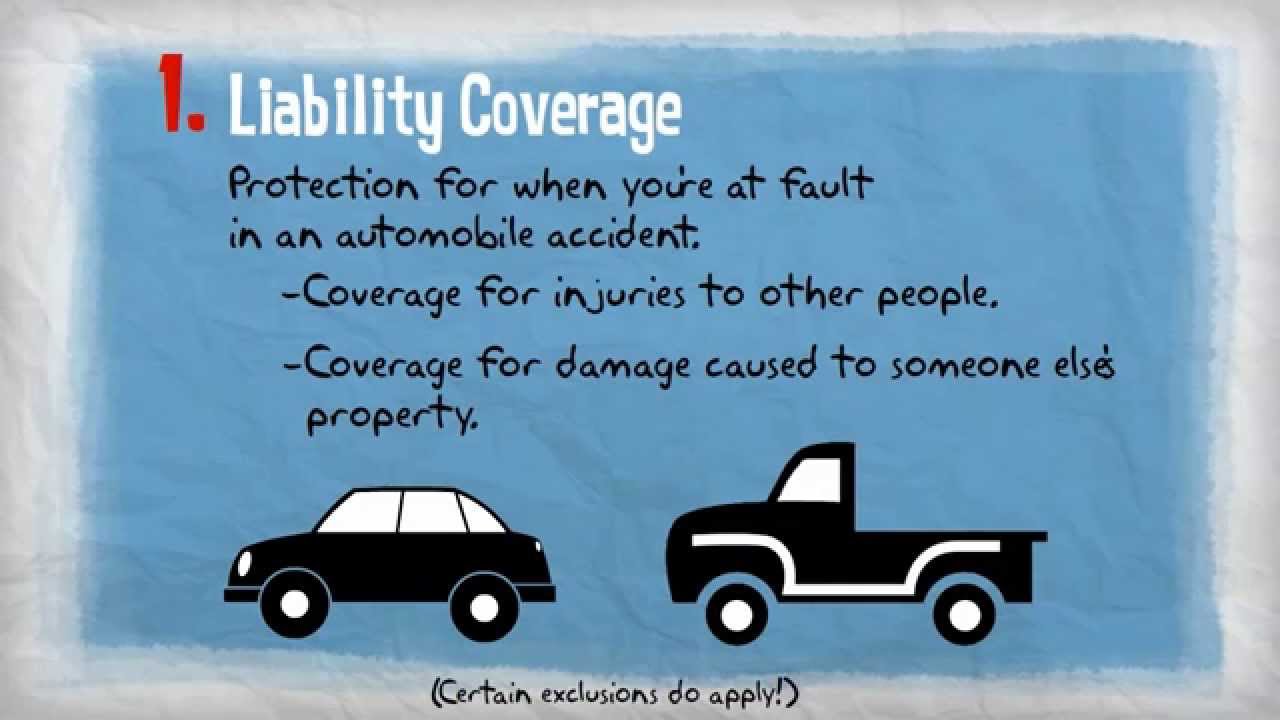

Liability is the most crucial sort of car insurance policy. What does obligation insurance cover? Exactly how does it function? And also just how much of it do you need, anyhow? We'll travel via the response to all these questionsplus just how much liability insurance prices in your state. So buckle up, as well as allow's get going! What Is Liability Insurance policy? Responsibility insurance coverage is one of the most crucial type of automobile insurance policy.

Meet Travis. Travis obtains in a cars and truck crash that's discovered to be his fault. Now he's liable for the damages he causedmeaning he needs to pay for the other chauffeur's cars and truck repairs and also clinical expenses. Travis doesn't have hundreds of bucks to pay those prices. He does have obligation insurance.

What Does Obligation Insurance Coverage Not Cover? Liability insurance coverage covers the other individual's expensesbut not yours. If your vehicle is trashed or you got whiplash, your obligation insurance coverage will not cover your fixing or medical bills. That's where other sorts of coveragelike your health and wellness insurance policy or car crash insurancecome in. (And also that's why it is necessary to have the right types of insurance to shield yourself financially from a vehicle crash.) Responsibility Insurance Protection Limits Below's something else you ought to understand about responsibility insurance policy: It will not cover every cost from currently till forever.

The coverage restriction is the maximum amount the insurance coverage business will certainly pay after you pay your insurance deductible. Anything over the insurance coverage limitation, you need to pay out of pocket. There are two kinds of protection limitations for liability cars and truck insurance coverage. Split Coverage Boundary The majority of obligation plans have different (also known as split) insurance coverage limitations for each type of damages.

Best Liability Car Insurance And Faqs - Insurantly - Questions

So insurance providers made the bodily injury per mishap limitwhich is the second number in your plan. laws. In our instance, the bodily injury per crash limitation is $50,000. That suggests the insurer will certainly pay for injuries to the various other vehicle driver and also their guests as much as $50,000. After that, you are accountable for all expenses.

She creates a mishap that results in $2,000 well worth of clinical costs and $20,000 in building damages. Her bodily injury obligation will certainly cover all the medical costs. Since her residential property damage limitation is $15,000, she still has to pay $5,000 to take care of the various other motorist's cars and truck. That's why some vehicle drivers choose a single protection limitation (likewise called a combined insurance coverage limit) policy.

The insurance provider would utilize that $90,000 to cover any kind of responsibility prices for the wreckno matter if they were injuries or residential property damages - cars. Single protection restrictions give you more adaptability when paying for damages, so it can be worth asking your insurance policy agent regarding the expenses of switching to this type of automobile liability policy.

And we'll be straightforward, in some cases that may be enough. The typical cost of building damages in a cars and truck crash is $4,600.1 As well as the price of an injury accident varies from about $23,00028,000.2 So your physical injury coverage might pay the various other motorist's and passengers 'medical costs. Below's the point. which Tammy's insurance policy likewise covers. Complete costs for Tammy to pay:$0. Although her accident was way worse than Jake's, her insurance will cover the costsso she can concentrate on replacing her own automobile and also healing from her very own injuries. See why it's so crucial to have all that insurance coverage? Okay, we have actually pierced on the significance of having lots of liability insurance coverage. (Seriously, it can add as little as $5 a month to your insurance coverage.

Which$5 currently can save you 10s of thousands later. That deserves it!)Exactly how to Update Your Obligation Insurance policy Obtaining the advised responsibility insurance coverage is extremely simple: Simply speak with among our Supported Local Providers(ELPs). They can also look for various other coverages you could need, like umbrella or accident insurance.

All set to deal with a vehicle insurance agent you can rely on? Obtain started right here. States differ one to the various other on what you're required to bring. If you still owe cash on the car, your lender might require you to purchase full protection car insurance. And also you may need to have void insurance coverage to assist spend for the cost distinction in between the amount you owe and also the minimal worth of your automobile. If you decide to choose up only the minimum amount of liability insurance called for by your state, you could conserve in the short-term, however you may wind up paying Click here for info thousands much more if numerous lorries are damaged in an accident and you're located at fault. Minimum responsibility coverage, which covers you for damages as well as mishaps you cause, is base coverage, at finest. It is essential to be conscious that Medpay or PIP is called for in most states, but not in all of them.

The smart Trick of What Is Liability Car Insurance Coverage - Belairdirect That Nobody is Talking About

So check with your representative about your state's lawful demands to discover how complete protection is mandated there. What Is Not Consisted of in Liability and also Full Insurance Coverage? Even if you've got complete protection, there are particular situations where you might not be insured. Mean a motorist with fundamental obligation protection is at-fault in a crash and also injures you.

Your uninsured or underinsured driver coverage can help to look after your clinical bills because situation (cheaper car). When contrasting full protection vs. comprehensive and collision insurance, it is very important to think about the whole, packed product. Full Protection vs. Obligation Price When assuming concerning the liability vs. complete protection cost difference, keep in mind that you're getting a great deal a lot more with complete coverage. Although you'll have some protection with fundamental liability insurance coverage, it might not suffice to shield you if you cause a crash.

When you think about the rate distinction between basic liability as well as complete insurance coverage, the extra expenditure can convert right into real peace of mind that comes with complete insurance coverage insurance coverage. As well as it can actually assist you to feel even more certain behind the wheel.

How do you understand what kinds you need? Is it needed by your state? Are there ways to save cash and still have the right amount of coverage? Below we information 5 sorts of protections and also supply a couple of circumstances where you would certainly take advantage of having a non-required protection included in your policy along with some pointers to conserve some money relying on your automobile and also budget plan.

Obligation insurance coverage will certainly cover the cost of repairing any building harmed by a mishap as well as the medical expenses from resulting injuries. Most states have a minimum requirement for the amount of responsibility insurance coverage that drivers should have. If you can manage it, however, it is generally a good concept to have responsibility insurance coverage that is above your state's minimum liability coverage requirement, as it will certainly give additional defense in case you are found responsible for an accident, as you are accountable for any kind of claims that surpass your protection's top restriction.

car insurance credit score insurers low cost

car insurance credit score insurers low cost

If there is a protected mishap, crash protection will certainly pay for the repair services to your automobile. If your vehicle is completed (where the cost to fix it surpasses the worth of the car) in a crash, collision coverage will pay the worth of your vehicle - insured car. If your cars and truck is older, it might not deserve carrying accident coverage on it, relying on the worth.

All About Non-owned Car Liability Insurance - Hiscox

Note: If you have a lienholder, this protection is called for. Suppose something takes place to your cars and truck that is unassociated to a protected accident - weather condition damages, you hit a deer, your car is swiped - will your insurer cover the loss? Obligation insurance policy and also accident protection cover crashes, yet not these circumstances.

Comprehensive coverage is among those points that is terrific to have if it fits in your budget - accident. Anti-theft and also monitoring gadgets on vehicles can make this protection somewhat much more affordable, yet carrying this sort of insurance policy can be costly, and also might not be required, particularly if your auto is conveniently changeable.

When you think about the cost difference between basic responsibility and complete coverage, the added cost can equate right into genuine tranquility of mind that comes with complete coverage insurance coverage. As well as it can truly help you to really feel even more positive behind the wheel.

Just how do you understand what types you need? Is it needed by your state? Exist methods to conserve money and still have the ideal quantity of insurance coverage? Below we information 5 types of coverages and give a few circumstances where you would certainly take advantage of having a non-required coverage included in your policy together with some tips to conserve some cash depending on your car and also budget plan - insure.

Responsibility insurance policy will certainly cover the cost of fixing any kind of home damaged by an accident as well as the clinical expenses from resulting injuries. The majority of states have a minimum demand for the quantity of obligation insurance coverage that drivers have to have. If you can manage it, nevertheless, it is generally an excellent suggestion to have obligation insurance coverage that is over your state's minimum obligation coverage need, as it will give additional security in case you are found responsible for an accident, as you are responsible for any type of insurance claims that surpass your protection's upper restriction.

If there is a protected crash, collision protection will certainly pay for the repairs to your auto (cheap insurance). If your vehicle is totaled (where the expense to fix it goes beyond the worth of the automobile) in a crash, collision coverage will certainly pay the worth of your auto. If your vehicle is older, it might not deserve lugging collision coverage on it, depending on the worth.

The Liability Vs Full Coverage? - United Auto Insurance Statements

money cheaper car cheapest auto insurance car insured

money cheaper car cheapest auto insurance car insured

Keep in mind: If you have a lienholder, this protection is called for. Suppose something takes place to your vehicle that is unassociated to a covered mishap - weather condition damages, you struck a deer, your automobile is swiped - will your insurer cover the loss? Liability insurance coverage as well as collision coverage cover mishaps, however not these circumstances.

Comprehensive insurance coverage is among those points that is excellent to have if it suits your spending plan. Anti-theft and tracking gadgets on automobiles can make this insurance coverage a little much more affordable, but carrying this kind of insurance can be expensive, as well as might not be essential, specifically if your car is conveniently replaceable.